How To Guide

Below is a How To Guide for safer online useage to help to prevent Fraud and Theft - Information taken from https://www.mcafee.com/learn/how-to-recognize-an-online-scammer/ - A reliable source to preventing scams

Recognising a Scam

- They say you've won a huge prize.

- They want you to pay in a certain way.

- They say it's an emergency.

- They say they're from a government organisation or company.

- The email is littered with grammatical errors.

Types of Scams - 1. Phishing scams

A phishing scam can be a phone or email scam. The criminal sends a message in which they pretend to represent an organization you know. It directs you to a fraud website that collects your sensitive information, like your passwords, Social Security number (SSN), and bank account data. Once the scammer has your personal information, they can use it for personal gain. Phishing emails may try anything to get you to click on their fake link. They might claim to be your bank and ask you to log into your account to verify some suspicious activity. Or they could pretend to be a sweepstakes and say you need to fill out a form to claim a large reward. During the coronavirus pandemic, new phishing scams have emerged, with scammers claiming to be part of various charities and nonprofits. Sites like Charity Navigator can help you discern real groups from fake ones.

Types of Scams - 2. Travel insurance scams

These scams also became much more prominent during the pandemic. Let’s say you’re preparing to fly to Paris with your family. A scammer sends you a message offering you an insurance policy on any travel plans you might be making. They’ll claim the policy will compensate you if your travel plans fall through for any reason without any extra charges. You think it might be a good idea to purchase this type of insurance. Right before leaving for your trip, you have to cancel your plans. You go to collect your insurance money only to realize the insurance company doesn’t exist. Real travel insurance from a licensed business generally won’t cover foreseeable events (like travel advisories, government turmoil, or pandemics) unless you buy a Cancel for Any Reason (CFAR) addendum for your policy.

Types of Scams - 3. Grandparent scams

Grandparent scams prey on your instinct to protect your family. The scammer will call or send an email pretending to be a family member in some sort of emergency who needs you to wire them money. The scammer may beg you to act right away and avoid sharing their situation with any other family members. For example, the scammer might call and say they’re your grandchild who’s been arrested in Mexico and needs money to pay bail. They’ll say they’re in danger and need you to send funds now to save them. If you get a call or an email from an alleged family member requesting money, take the time to make sure they’re actually who they say they are. Never wire transfer money right away or over the phone. Ask them a question that only the family member would know and verify their story with the rest of your family.

Types of Scams - 4. Advance fee scam

You get an email from a prince. They’ve recently inherited a huge fortune from a member of their royal family. Now, the prince needs to keep their money in an American bank account to keep it safe. If you let them store their money in your bank account, you’ll be handsomely rewarded. You just need to send them a small fee to get the money. There are several versions of this scam, but the prince iteration is a pretty common one. If you get these types of emails, don’t respond or give out your financial information.

Types of Scams - 5. Tech support scams

Your online experience is rudely interrupted when a pop-up appears telling you there’s a huge virus on your computer. You need to “act fast” and contact the support phone number on the screen. If you don’t, all of your important data will be erased. When you call the number, a fake tech support worker asks you for remote access to your device to “fix” the problem. If you give the scammer access to your device, they may steal your personal and financial information or install malware. Worse yet, they’ll probably charge you for it. These scams can be pretty elaborate. A scam pop-up may even appear to be from a reputable software company. If you see this type of pop-up, don’t respond to it. Instead, try restarting or turning off your device. If the device doesn’t start back up, search for the support number for the device manufacturer and contact them directly.

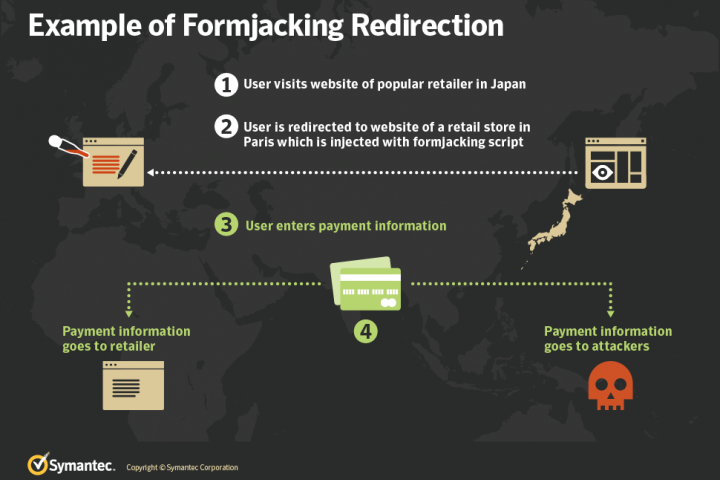

Types of Scams - 6. Formjacking and retail scams

Scammers will often pose as popular e-commerce companies by creating fake websites. The fake webpages might offer huge deals on social media. They’ll also likely have a URL close to the real business’s URL but slightly different. Sometimes, a criminal is skilled enough to hack the website of a large online retailer. When a scammer infiltrates a retailer’s website, they can redirect where the links on that site lead. This is called formjacking. For example, you might go to an e-commerce store to buy a jacket. You find the jacket and put it in your online shopping cart. You click “check out,” and you’re taken to a form that collects your credit card information. What you don’t know is that the checkout form is fake. Your credit card number is going directly to the scammers. Whenever you’re redirected from a website to make a payment or enter in information, always check the URL. If the form is legitimate, it will have the same URL as the site you were on. A fake form will have a URL that’s close to but not exactly the same as the original site.

Types of Scams - 7. Scareware scams (fake antivirus)

These scams are similar to tech support scams. However, instead of urging you to speak directly with a fake tech support person, their goal is to get you to download a fake antivirus software product (scareware).

You’ll see a pop-up that says your computer has a virus, malware, or some other problem. The only way to get rid of the problem is to install the security software the pop-up links to. You think you’re downloading antivirus software that will save your computer.

What you’re actually downloading is malicious software. There are several types of malware. The program might be ransomware that locks up your information until you pay the scammers or spyware that tracks your online activity.

To avoid this scam, never download antivirus software from a pop-up. You’ll be much better off visiting the website of a reputable company, like McAfee, to download antivirus software.

Types of Scams - 8. Credit repair scams

Dealing with credit card debt can be extremely stressful. Scammers know this and try to capitalize off it. They’ll send emails posing as credit experts and tell you they can help you fix your credit or relieve some of your debt. They might even claim they can hide harmful details on your credit report. All you have to do is pay a small fee. Of course, after you pay the fee, the “credit expert” disappears without helping you out with your credit at all. Generally, legitimate debt settlement firms won’t charge you upfront. If a credit relief company charges you a fee upfront, that’s a red flag. Before you enter into an agreement with any credit service, check out their reputation. Do an online search on the company to see what you can find. If there’s nothing about the credit repair company online, it’s probably fake.

©CopyrightElderlyAssistNI

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.